Cereal grains are considered strategic crops in Zimbabwe because of their centrality as a reference for the country’s food security status. Adequate supply of cereal grains is essential to food security. Whilst there is potential for adequate supplies in normal rainfall years, the increased frequency of extreme weather events like droughts and floods results in increased frequency of periods of shortages and food insecurity. Most of the cereal grain production is rainfed (except wheat) and the annual production is correlated to the rainy season quality causing variability in the annual aggregate cereal grain output.

The Grain Marketing Board has maintained a de jure monopoly on maize and traditional grain procurement, sales, and exports. Pre-planting prices are announced to influence the decision of farmers to grow maize and traditional grains. A final producer price is announced at the before the beginning of the marketing season. In 2021 the pre-planting price announced at the beginning of the 2020/21 growing season was maintained as the final producer price for the 2021 marketing season.

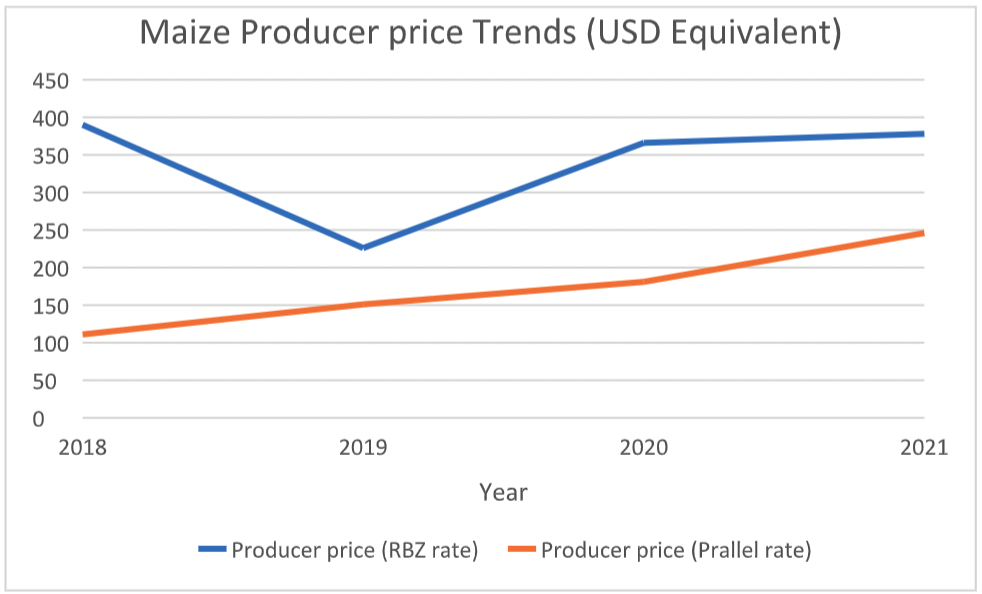

In 2019 The monetary authorities maintained a 1:1 exchange rate between the Zimbabwean RTGS and the United States Dollar. This policy was abandoned to move to an auction determined exchange rate system. Figure 1 shows the trend of final producer prices announced at the start of the marketing season converted to their USD value at the Auction rate and at the parallel market rate.

Figure 1, Maize producer price trends

Source: Author Computations, RBZ

The parallel exchange rate is an important variable when analysing farm profitability. Input suppliers and other agricultural service providers index their ZWL$ prices to the USD using the parallel market rate (which is illegal but prevalent). In some cases, retailers refuse payment for equipment or spare parts in ZWL$, preferring instead USDs. Their argument is that they are not able to obtain the USD on the RBZ auction system hence the need for customers to pay for inputs in USD. Most of these inputs are imports that require foreign currency. The parallel market rate has always maintained a significant premium over the official rate. As such, farmers who are paid in ZWL$ must convert their money to USD at the parallel market rate thereby losing value in the process. Figure 1 illustrates the argument. As shown in the trends, the real value at the parallel market rate is far much lower than when the producer price is converted at the official auction rate. Whilst it may appear that farmers are getting good prices at the official rate, the rate that they face on the input market is the parallel exchange rate which in effect pushes their earnings far below the import parity price.

Further analysis shows that farmers also lose value within a single marketing season. For the 2020/21 marketing season, a maize producer price was announced in local currency at ZWL$32,000 per ton. At the time of announcing this price it was equivalent to USD378.00/ton using the prevailing official exchange rate of ZWL$85.00 to the USD. The producer price was maintained over the marketing season. In December 2021, the official auction rate was ZWL$109 to the USD. At this rate the USD equivalent of the producer price was USD293.00. This was a loss in value of 22% in the same marketing season.

In view of the challenges chronicled above, it is recommended as follows.

- The government should consider indexing the ZWL$ denominated producer price to the stable USD to maintain value in the current inflationary environment.

- The monetary authorities should find a lasting solution to the widening gap between the official and parallel foreign exchange rates.

- There is need for policy consistency regarding the procurement of grains. The government gone full cycle over the years, from controls to liberalization and back to controls, thereby crowding out private players in grain production and marketing.

- If government maintains ZWL$ producer prices and the inflationary environment persists, farmers are encouraged to deliver their grain early in the marketing season to avoid losing out the value of their produce.